The last most expected economic event week of the year finished with US CPI results, FOMC Summary of Economic projections and the BoE and ECB decisions.

As we covered in our CPI Recap, this week we started with low volume and volatility and With gold continuing the bearish move from Friday’s labor data results where the first focus was on CPI on Tuesday.

CPI data came within our expectations where we didn’t expected surprised data and came almost in forecast beside Inflation Rate MoM a 0.1%. Such didn’t brought any major market moves where such results were already priced in, setting the focus for FOMC on Wednesday.

Before FOMC we still had PPI, which usually is right after CPI, and results were mixed in the way that we saw an improve of MoM to 0% from -0.4% but less than expected 0.1% and Core to remain at 0% as previous. We did not gave much focus on such since FOMC were just a couple of hours after and was the main event of the week.

First and foremost we need to apologize our readers as our expectations were to have an hawkish Jerome Powell, for the reasons stated on our weekly preview, in the way that markets were well anticipating the rate cuts making Gold and US30 to print ATHs and with CPI figures within the forecast and not seeing significant downside, for us would make sense for Powel to cool down such effects in order to keep their dual mandate of bringing inflation down and keep labor market tight. Although what we saw was a dovish Summary of Economic Projections, pretty much what we could expect to see, but also a very dovish speech of Jerome Powell fueling Bulls on Gold and Equities and weakening Dollar.

For us retail traders, such was positive as we got some good Gold buys and adapted to the situation because our job is not to predict “results” but to understand them and adapt accordingly.

Before diving into SEP, the FOMC statement was pretty much a copy paste from previous with minor changes, same they did previously as “slowed”, “ease” and “any” were added.

“we added the word "any" as an acknowledgement that we believe that we are likely at or near the peak rate for this cycle. Participants didn't write down additional hikes that we believe are likely, so that's we wrote down…” - Jerome Powell

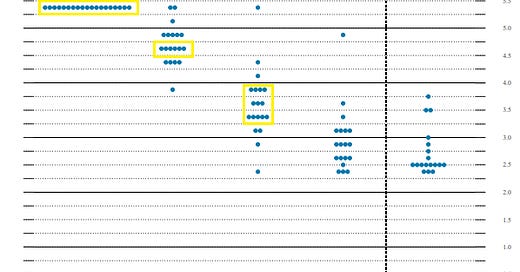

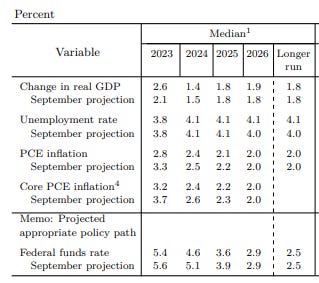

Looking now at SEP, the first points to highlight are the projections from last September revised downwardly for inflation to decrease to 2.8% PCE (actual at 3%) and 3.2 Core PCE (actual 3.5%) and to keep UER at 3.8% (actually at 3.7%) and GDP to increase to 2.6%.

Such downward revisions, according to Jerome Powell, were set by some members after knowing the results of the latest CPI and PPI which goes inline with such dovish stance as their job is getting done.

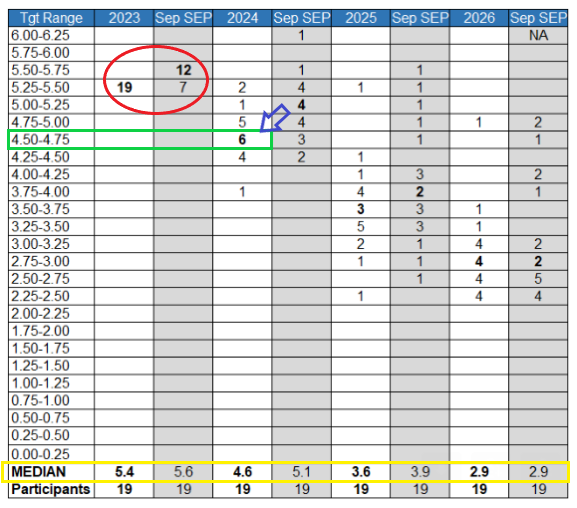

Looking on the Dot Plot it definitely can be clearly seen the dovish stance adopted by voters in short and long term. Unanimously all of them voted to keep rates as-is as in September they left door open for one more rate hike and to highlights also is that no one sees any rate above 5.25-5.5, means, no more rate hikes.

Translating such dot plot into votes and apply some statistics we can see the differences from the September projections and December ones.

Within the red “circle” we can see the 12 members that previously were seeing one more rate hike to close of 2023 were now supporting to keep it as-is. The other dovish remark is that for 2024 which is what is in focus now, what in September were projections for rates to be cut in 50bps (as majority were seeing 5.5 - 5.75 as last rate) not only we kept on 5.25-5.5 but now we see a 75bps cut into 2024, where most of them see rates at 4.5-4.75 but for the majority we need to add “or lower” as we have 11 that sees them at this levels and only 8 above. Such can also be seen within the yellow square as the median for 2024 is 4.6 instead of the 5.1 as of September.

If such was dovish information released at 19:00 (UTC), 30m later we got Powell inline with such projections with markets already reacting to such sentiment with Dollar tanking and Gold spiking with remarks like:

we believe that our policy rate is likely at or near its peak for this tightening cycle

Jerome Powell on rate peaks

Inflation has eased from its highs, and this has come without a significant increase in unemployment. That's very good news

Jerome Powell on FEDs dual mandate

We are seeing strong growth that appears to be moderating, we're seeing a labor market that is coming back into balance by so many measures, and we're seeing inflation making real progress. These are the things we've been wanting to see… No one is declaring victory… So we're moving carefully in making that assessment of whether we need to do more or not… That's really what happened in today's meeting

Jerome Powell on rating cuts

I have always felt since the beginning that there was a possibility, because of the unusual situation, that the economy could cool off in a way that enabled inflation to come down without the kind of large job losses that have often been associated with high inflation and tightening cycles. So far, that's what we're seeing. That's what many forecasters on and off the committee are seeing. This result is not guaranteed. It is far too early to declare victory and there are certainly risks.

Jerome Powell on Soft Landing

So we're aware of the risk that we would hang on too long… we're very focused on not making that mistake we've come back into a better balance between the risk of overdoing it and the risk of underdoing it

So I think we'll be very much keeping that in mind as we make policy going forward…the reason you wouldn't wait to get to 2% to cut rates is that it would be too late…

Jerome Powell on early rate cuts

These are just some statements that Powell did during the speech and Q&A and as we can see was very dovish in all of them and that went against our personal expectations, but we were able to adapt to markets reaction as such gave a great strength on Gold and weakening on Dollar.

As we can see, on first hour of FOMC decision, Gold went from 1982 straight up into 2018, closing the day at 2032 and after that during the week we saw it ranging on weekly highs, closing today with a friendly pullback. ON the other side, we had Dollar tanking to an area we have been highlighting at the 103 but kept the sentiment retesting 102s and starting a minor pullback today, keeping is bearish move and not breaking it at 104.2 showing that FOMC was the make or break for such to happen.

Through the rest of the week had optimistic US data with improve Jobless and Retails Sales returning unexpectedly into positive numbers but such held very short term impact only noticeable at LTF. Friday, mixed PMI flash, poor NY Manufacturing and good industrial production hold minor weight as the downside move on NY was mainly related to FED Williams hawkish remarks.

Beside we usually don’t cover ECB and BoE, this week we had their decisions to keep rates as-is and in opposite to FEDs they came in hawkish as their mandate to keep inflation down is lagging from FED that started their job earlier.

From now one we will enter in holidays period and the only relevant US economic results until EoY will be Q3 GDP and PCE that will be revealed before Christmas. With such we will also go on vacations in our Weekly Overviews and Recaps, but if any relevant situation occurs on the markets we will come back.

Thank you very much for being on that side and hope that our posts have been helpful. We look forward to improve for 2024. take this time to reflect, recap the year, review the progress, highlight the strengths and weakness, set a plan to convert weakness into strength to improve your performance.

Finally a very Happy Christmas for you and your beloved ones and hopes that 2024 to reward you with the best that you have been working for.