12-12-2023 - US CPI Data on forecast

CPI data on forecast and all eyes on (hawkish) FOMC tomorrow

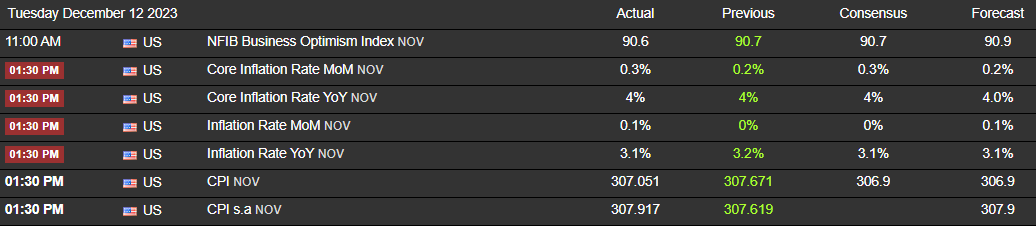

One of the most expected events of the week occurred today where we had the “worst” scenario for us as retail traders with CPI data on forecast and leaving markets a bit choppy with eyes now for FOMC tomorrow.

Before we jump in to CPI, this week we started according to our expectations in which we had low Volume and volatility on Monday across the board, although Gold kept his bearish move from Friday’s NFP data slow and steady coming down to print new lows at 1976. On the other hand, Dollar was purely ranging with 104 to 104.2 and today with CPI grabbed liquidity at 103.5 but still failed to break highs at 104.2s.

During the data release Gold grabbed went choppy and markets reacted as such won’t feed into the early rate narrative in play as CPI is still in such sticky zone which would lead for sure to Powell tomorrow coming hawkish as the “job is not yet done” and so such take Gold to not keep is bullish stance kept in such range within 1980 and 1988, although will be interesting to see how the daily candle will close.

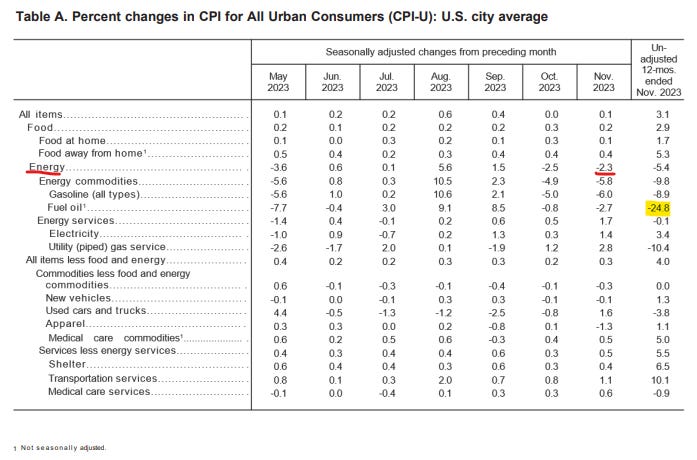

Looking at the CPI, we won’t expect that it could be surprise as we referred on our weekly preview, in the way that energy prices are still declining.

“our expectations is CPI to not have surprisingly data and much probably to keep the same as previous or according to forecast.”

In our Weekly 50 Preview

Looking at the results we can see that Core CPI came the same as previous at 4% and if we look into the charts, this was the first time in the last year that there was no variation.

On CPI YoY that came as forecasted at 3.1% the major contributor again was the decline of energy prices. The Commodities and Gasoline decline even more than in October and to highlight the sink on Fuel Oil, on unadjusted data, was at 24.8% less.

With this data being on such sticky areas and seeing small to none inflation variations shows that FEDs job is not in fact done and with all the policy base effects gone we enter in a risky area that an upside inflection of the data has potential to occur. With such and looking now to FOMC tomorrow, we expect Jerome Powell to bring back the hawks with him with an hawkish speech/Q&A to cool down the markets where Gold printed a new ATH and Equities (US30) is retesting it. So this is a perfect price setup for both to turn bearish (which also leads to Dollar bulls), at least for short term until a new set of data keeps the narrative of FED early rate cuts comes back in play.

We keep tour stance for tomorrow that the decision itself will be to keep the rates as-is and focus on SEP and Powell speech.