19-02-2024 What happened since FOMC?

Last two weeks review with FOMC decision, Labor data and Inflation figures

First and foremost we need to apologize to our readers, because we were not able to provide updates for the last two weeks because a lot has been going on and we don’t want to loose track of it, so, let’s go on a review of what happened since our last post of FOMC & labor preview.

If you remember, before FOMC decision we started to notice that the rate cut narrative could be loosing its strength due to the US optimistic data that we kept receiving, providing the higher for longer narrative to come back in play. FOMC expectations relied on Jerome Powell tone speech, as keeping rates as-is was expected by everyone, because in Dec FOMC meeting, JP brought a strong dovish sentiment. This time and with almost an hour long press conference, JP was more careful on his speech and started more neutral but finished hawkish by removing chances of rate cuts in March.

BASED ON MEETING TODAY, I DON'T THINK LIKELY WE WILL HAVE A RATE CUT IN MARCH

Jerome Powell, FOMC press conference

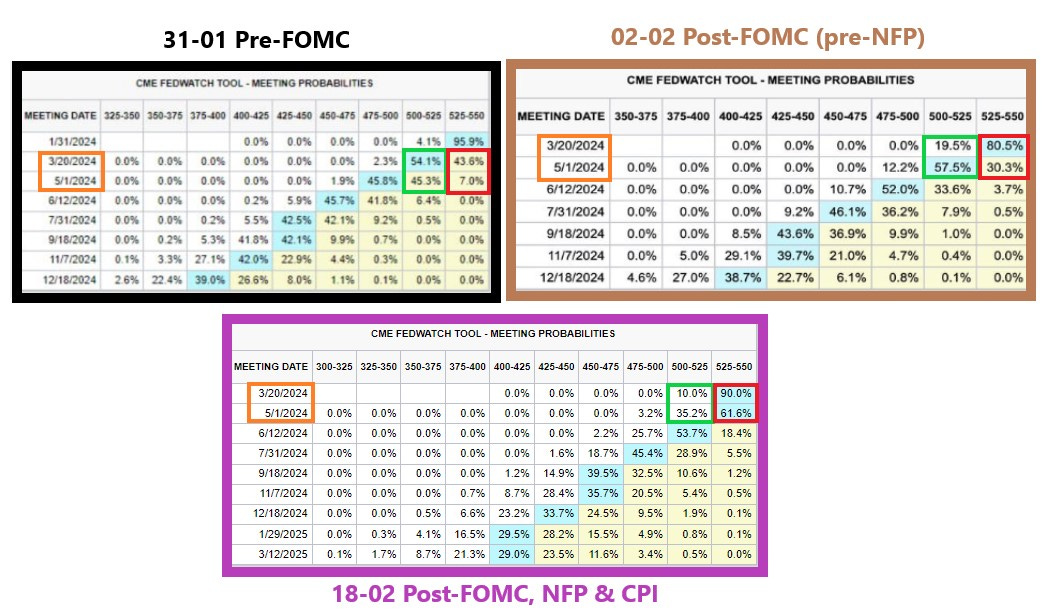

If such was supposed to “kill” early rate cuts narrative, such, wasn’t strong enough to remove the greed from the markets but as we can see below a short history on market probabilities of rate cuts we have the following.

Before FOMC (black square) March and May probabilities were to see a rate cut as we have been seeing since Nov. 2023. After FOMC but before NFP on 2nd of Feb. (brown square) with JP statements, probabilities changed from 43% to 80% for 525-550 but still betting on cuts in May. After the high readings of CPI (purple square), it switched and not only 90% sees no changes in March but also 61% still bets to keep rates as-is. The point here is, in fact, from the FEDs point of view nothing changed and the only thing that changed was the market greed and we need to go back to Sep. 2023 to see similar probabilities as we see today when FED told that rate cuts weren’t expected until 2nd half of 2024.

Looking on the charts, we did an yearly review of 2023 where we stated when this rate cut narrative started, early Nov. post-Israel-Hamas conflict, and now beside this rate cut narrative is fading out, market greed is not and Gold is still above 2000s and respecting his HTF bullish market structure, being the 1980s the price point of interest to break it.

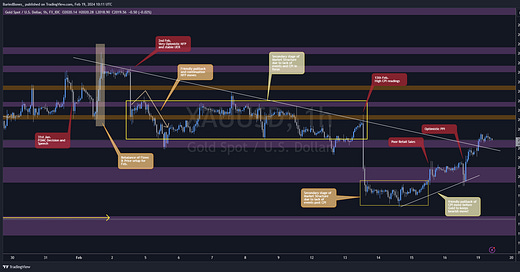

But what happened since FOMC then?

As you can see above, after FOMC Wednesday we had a counter move on Thursday before NFP as we identify it to be a Rebalance of Flows due to the fact data from that day doesn’t support such upside and due to new month coming, we consider it as a price setup for what was to come.

With very optimistic NFP and stable UER on Friday 2nd we saw about 300pip move to the downside that, on Monday after a friendly pullback, gold kept the same sentiment with more 200+pips down, which is very normal when we have a one sided data sentiment. After it, we enter on a secondary stage of Market structure where the focus was CPI to occur only on 13th Feb. In the middle, on Friday 9th we had unexpected headlines of BLS on some higher CPI revisions of 2023 where the last three months we notice higher readings than the ones that were reported.

Revisions show U.S. consumer prices a bit firmer than previously reported

Beside such whipsaws we were not able to break that consolidation range until CPI data on Tuesday 13th. Data came with higher readings except for IR YoY with a slight decrease but less than expected and that made Gold to dump 400+pips to the 1985s, but so far was only short term that was below the 2000 price mark, as we write such post is at 2016, pulling back and as we believe to continue is bearish move.

On the DXY, with such economic results, dollar pushed higher as we expected hitting the 105 mark.

As we can see, our expectations were to hit the 104 first with a make or break, and CPI made him to hit the 105 and now doing a pullback to retest previous highs before continuing higher as we expect.

Well, arriving now to this new week, which is smaller for North America due to todays bank holiday, this week will be pretty quiet in terms of economic events and in such conditions is better to be more selective as markets can range until the week after where we have more economic data for us to work for, nevertheless, we are still bearish on Gold and bullish on DXY, but we should be careful because we need more for markets to be bearish than bullish, and such can be seen on US30 as, if the rate cut narrative is fading out meaning rates higher for longer are to stay as it was on Q3 2023, why is US30 hitting ATHs? Well, so far I can also say that greed is also on it’s ATH, where good data is good data, and bad data is also good data in the way that CPI move was already faded out.

So, for this week we should keep our expectations low, if no reactive events come, and be more selective on our setups that can take longer to be fully executed or take quick jabs in and out the markets.

Stay safe, trade safe and trade smart.

Welcome back, new subscriber here