With January month almost coming to an end, we arrive to the 5th week of 2024 with FED decision and US labor market in focus. So far early rate cuts narrative lost some steam but will Jerome Powell support them or bring the hawk back?

Since the start of the pandemic that Central Bank policy is being the main market driver of the financial markets with some exceptions along the path where it decreased momentarily its weight like when markets started to price in Russia-Ukraine war, US and EU banking collapses and most recently the Israel-Hamas conflict (including the Red Sea tensions) and so when we arrive to such weeks, where we have FOMC, such report get the main focus and usually fading out the ones we have until the decision and speech. For this reason and looking at the economic calendar above, we will have FOMC on Wednesday and until there the other economic reports could hold less market weight so it is better to set our expectations low until Wednesday.

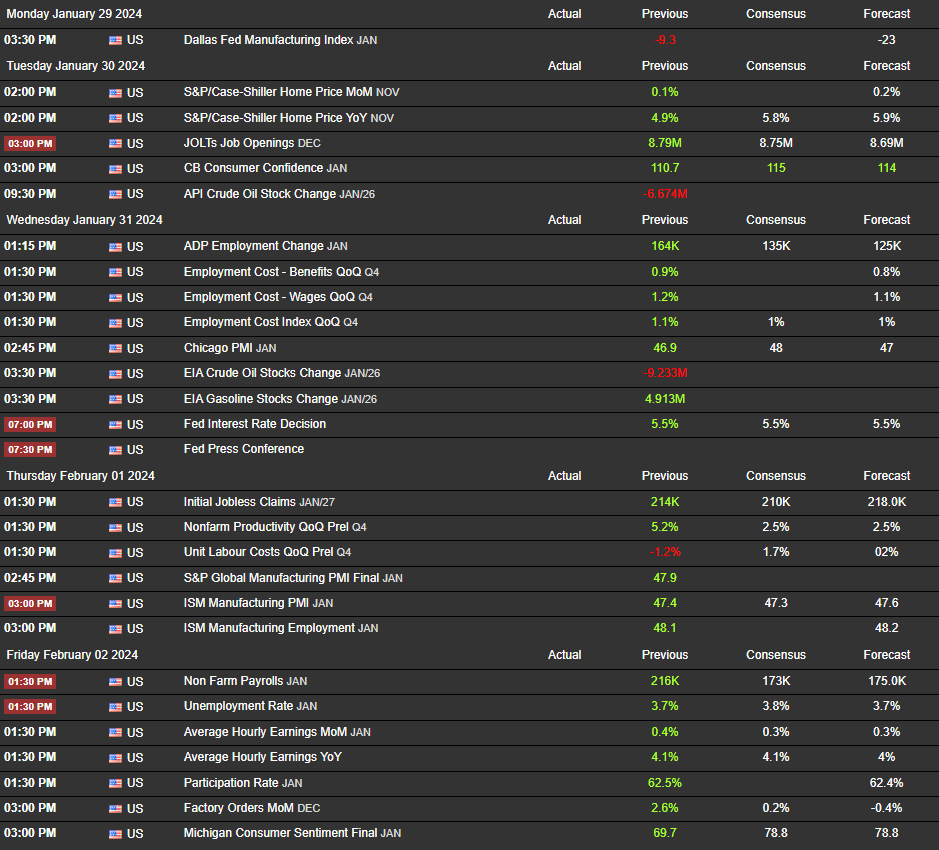

Beside FOMC the week will also report important labor and consumer data and as we enter on February we will start to receive the first reports from 2024. We will start out with Dallas Man. index which is expected to be very low in the same way we got NY and Philly, then, we get the JOLTs still for Dec and CB Consumer Confidence with optimistic expectations which is very possible to occur (beside we had a very poor Durable Goods). Then Wednesday comes with another private sector labor for ADP Employment with decrease expectations and the decision and JP speech.

In regards to the FOMC, markets priced in the no change in rates which is the same as we see because there is no reason for the FEDs to hike nor cut but what will be key is Jerome Powell speech. Answering to our question on the introduction, what we will expect is neither to support the narrative nor to bring the hawk back, but a more neutral to, eventually, a slight hawkish speech in order to keep markets more stable as they say “foster price stability”. On Thursday, where markets digest what happened during FOMC we need to be vigilant on PMI reports because remember that S&P flash expected healthy figures and markets priced it in, so any different result could lead to some whipsaws but usually ISM PMI holds more market weight, which is reported 15m after.

As this week labor data is also in focus, the Jobless claims might not have much weight, unless some huge surprise, and on Friday we will have the first important labor data for 2024 with NFP and UER. To assess if this day could set the tone for the week after, might depend on JP speech and what we see is if JP will act according to our expectations, markets can react more on Friday to the labor data reports but if JP will set on one sided (rate cuts narrative or rates higher for longer), such data could hold less impact in the way that could not fade JP speech if it goes against or even could amplify it if the reports goes in favor, I mean, positive labor data with higher NFP and lower UER feed the rates higher for longer (JP Hawkish) and negative labor data with lower NFP and higher UER feeds the narrative rate cuts (JP dovish). With this we almost forget that we still have factory orders and Mich. Consumer sentiment that of course their weight will only depend to what happens until this moment.

So as you can see, this week can be pretty interesting but mainly for the second half. Another aspect to keep in mind beside we don’t believe that may occur this week due to important data is the end of the month rebalance of flows move. It is only important to highlight because we will enter in times that it can occur but we see high chances for such to happen on the week after (week 6) that will be much more calm in terms on economic calendar events.

Looking now at the charts, we expect Gold and Dollar to range until FOMC decision and speech. If JP will bring the hawks back, they can both break their macro market structure as Gold will break the 2000s heading to the key area of 1980s to see if continues bearish and Dollar the 104s make or break area to continue bullish. Neutral JP can create indecision but also can feed the rate cut narrative in play and dovish will make Gold bulls breaking the 2040s heading to 2080s or higher and keep Dollar bears to 102s and lower.

No matter what our job is to understand and adapt accordingly, so expect a second half of week interesting and remember that until there we might not get the best market conditions.

Trade Safe, Trade Smart and prepare yourself for the week to come.

Great market analyst