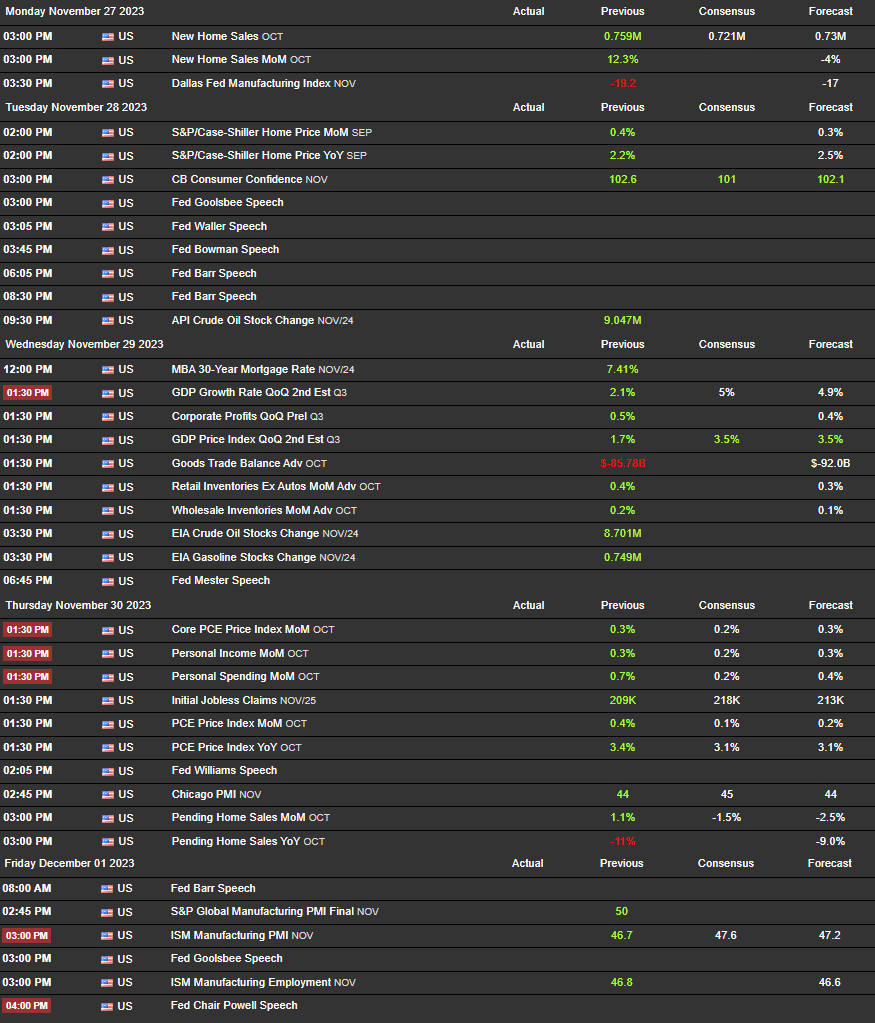

With the last week of November coming and after US holidays for Thanksgiving, we will have interesting economic data to lookout for on GDP with PMI and Growth estimations for 3rd Quarter, Inflation with PCE and Consumer with Personal Income, Consumer Sentiment and confidence. The week will close already in December with Jerome Powell speech at London close hours.

Housing data will open the week for US economic data on Monday and Tuesday after Holidays. It’s not expected that such data could hold much weight so the eyes for economic data will be focused on mid to end of the week.

On Wednesday we will have GDP data estimations for the 3rd Quarter where the first estimation last month was for 4.9% it will be interesting to see such report as forecast is expected higher levels. Thursday we will have important PCE data, which will be the last PCE report before FOMC in three weeks. Remember that FED expectations on PCE is to close of the year on 3.3% inflation and previous report was at 3.4% and now expectations are for a decrease which if so early rate cuts on 2024 get strength on market sentiment as we have seen also on CPI report declines.

The PMI data to close of the week will also be important to watch as we have ISM Manufacturing PMI with expectations to increase but to keep in negative territory, but bear in mind last week the S&P Manufacturing report declined and they report the same type of data but have different ways to measure.

Last but not least we will have a lot of FED speakers through out the week and we will close with Jerome Powell. This week will be the last one before the blackout period that will start on 2nd Dec.

According to federealreserve.org, Jerome Powell will be attending a conversation with Spelman College President, at that college so we need to see if such talk will be related to economic outlook or monetary policy related. If not we will probably see such headline right on the start of the conversation else, we need to see if he will bring anything new to the table in regards to the new data reports we had since his last appearance.

Going into the charts, Gold closed of the week above the 2000s mark which is an interesting price point. According to history this was the 7th time that happened on the weekly and not only we will be entering on an EoM week which there is high chance of rebalance of flows move with a potential pullback for better price setups for the new month, but also, a break to the upside could lead to gold heading to break October highs of 2010 and follow previous wicks at 2020s and 2040s.

We need to remember that we are in a bullish bias for Gold with the weaker US economic data we have been receiving with markets pricing in early rate cuts in 2024. Although a potential pullback will also be interesting to see, we believe that for Gold to head higher a strong catalyst must occur as it happened before, with pandemic, Russia-Ukraine conflict and banking sector crisis. Right now Israel-Hamas conflict is priced in so expectations for a quiet start of the week are higher.

Dollar on the other hand still in its bearish move after the double top at 107.1s.

Right now we see higher chances, if it breaks this previous lows at 103s, to revisit 102s before the 101s, although potential pullbacks to 105s before going down could also occur. In order for us to see more strength on DXY, technically we need to break the 107s highs to be bullish again on Dollar but that we will be able to assess fundamentally first to see what will drive it higher.

No matter what we need to bear in mind that all the known geopolitical tensions are fully priced in and CB monetary policy is still the main market driver, so the ongoing US economic reports will have a strength effect on Dollar if reported good as economist and investors sees FEDs keep rates higher for longer with the opposite applying also.

So be safe, set your expectations accordingly for the start of the week, be vigilant for headlines that could affect the markets and trade smart.