The most expected event on the week occurred yesterday where we saw the expectations met where we had no changes on the hike, JP speech pretty solid with hawkish stance and V&V within our expectations, pretty similar from the June 14th one as we presented on the overview.

So decision came to no change on the rate and keep-it as-is, but during the speech and as expected JP gave some hawkish remarks mainly to keep the markets “stable” to avoid some easing. Remember that any minor word or any symptom of easing he passes out, markets will react accordingly and that can lead to enter in out-of-control spiral of inflation due to the fact that everyone wants the fed to ease and stimulate. During his speech JP reinforced the stance about keep rates higher for longer in order to achieve their goals not giving signs to ease.

We are prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we are confident that inflation is moving down sustainably toward our objective. - Jerome Powell

Now What?

If you notice, this FOMC brought some more information than the usual (except for March and June) which is called SEP - Summary of Economic Projections. The SEP is a quarterly report released by FED in which the members provide an insight on the US economic projections for the remain years, in areas like, Rates, Inflation (PCE), GDP and Labor. The report brings a lot of information for investors and economists and is used to analyze potential FED actions in short and long term dictating where the US economy could go and what monetary policy actions could be done.

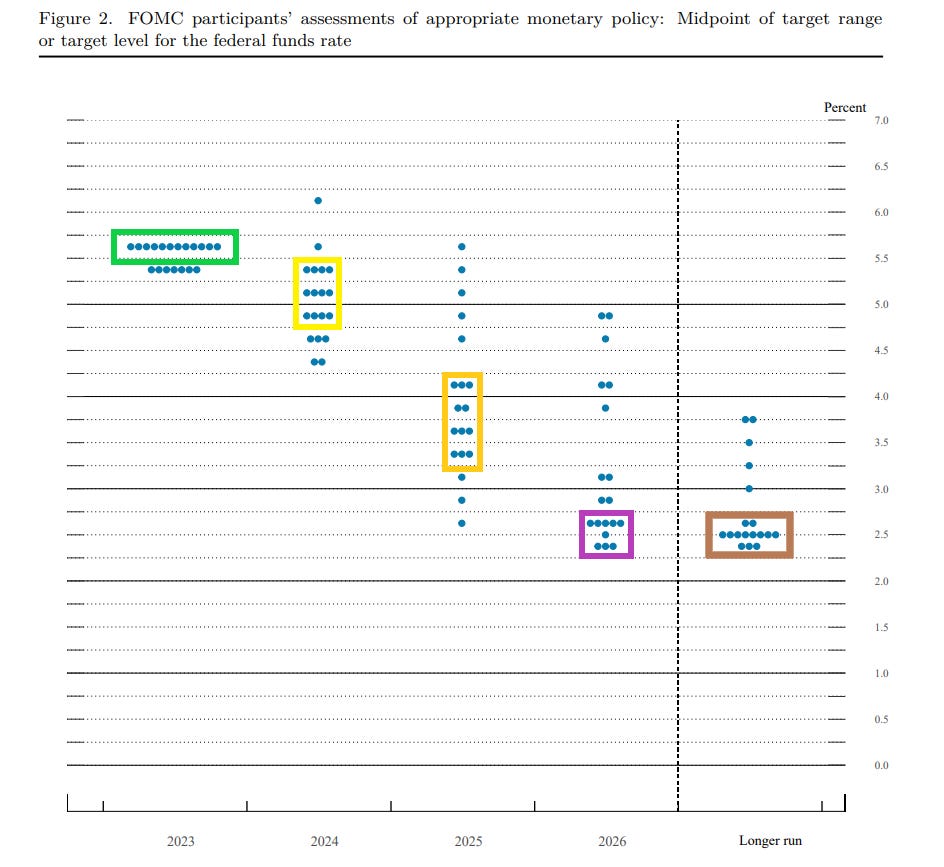

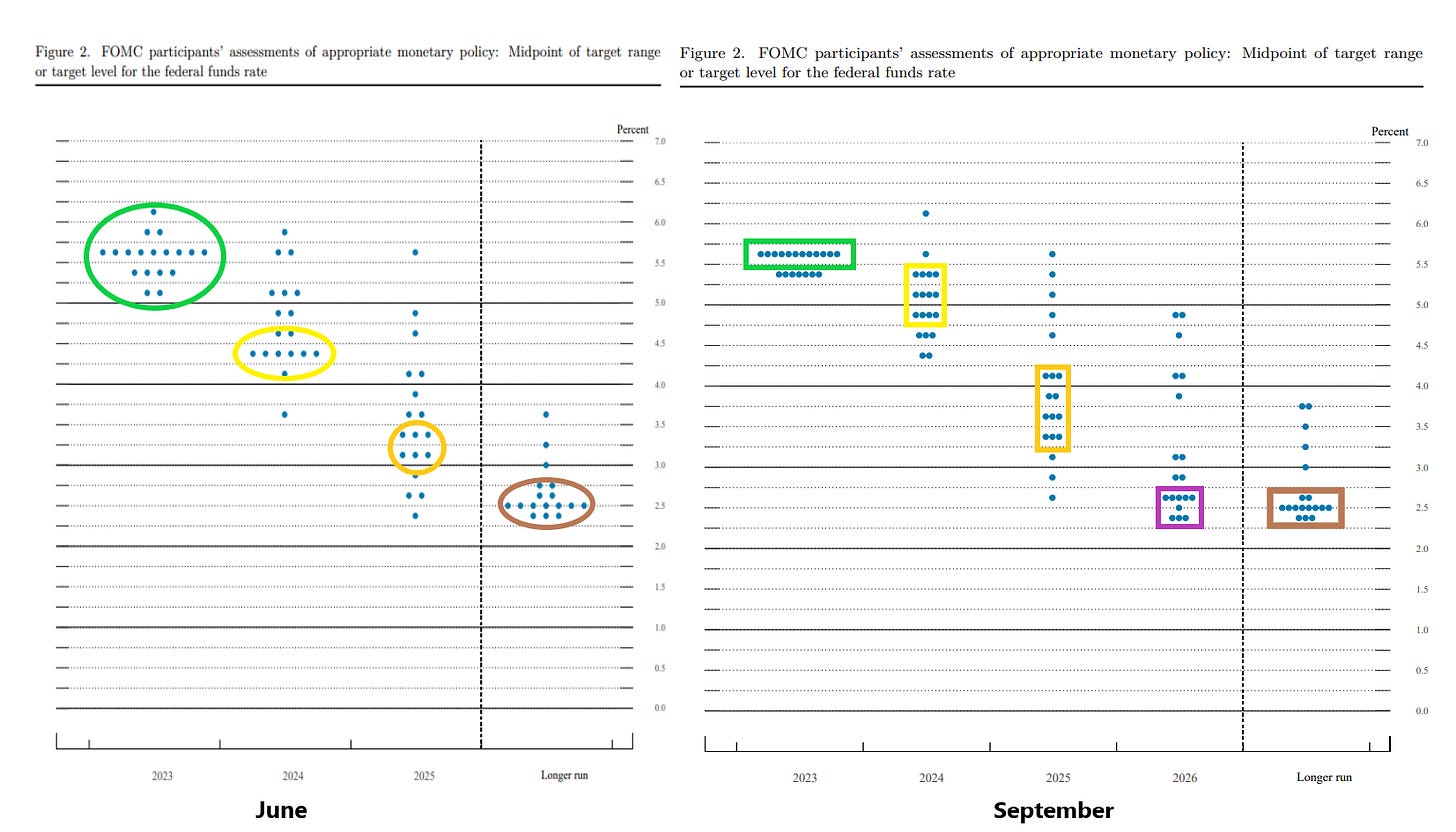

In such report, where we could do another article covering it up, but one of the most expected chart is the “dot plot”. The dot plot shows anonymously what members projected in regards to inflation rate targets for the remaining year and the next ones, with each dot representing each member of the committee.

What we can assess here, is that another rate hike is well seen by the majority of the members to 5.5 - 5.75 until December, also the projections for next years rate quite indecisive on 4.75 - 5.5 (5.1%) for 2024 and 3.25 - 4.25 (3.9%) for 2025 and 2.5-2.75 for 2026 and in the long run, coming into 2.5%. It’s inline with JP speech where hawkish stance from FEDs in keeping their job done, by taking inflation down.

Comparing to previous projections from June report there is more consolidation for a rate hike still this year, an increase for 2023 and 2024, but longer to have it on 2.5% (2026 projections appeared for the first time on yesterdays report)

Beside the “dot plot” we also can read the projections for GDP, PCE and Labor. As we can see below, there are still expectations for inflation and GDP to decrease except Unemployment.

In comparison to June projections, GDP is expected to grow to 2.1 this year with reductions for the next ones (the policy lag effects in play), Inflation projections still slight rise for 3.3 PCE and 3.7% Core PCE, but unemployment rate to stabilize at 3.8% which is the result of last report in early September.

With such what we can expect is still an hawkish FED that lead to dollar bulls and Gold bears, but we need to keep also assessing report by report and adapt accordingly because optimistic US data can lead to sentiment shift and other factors like BoJ rate decision or speech heading to a tighten policy conditions can bring a strong pullback on dollar with yen gains. It’s not the first time we see it so stay adaptive.

Beside this FOMC we had SEP report, but remember what Powell said

FED projections are not a plan, policy will adjust as appropriate

For today we need to keep in focus the BoE rate decision and speech. Even though we have expectations of an hike, recently softer UK CPI brought some doubts. Although focus will be on speech if it goes in line with ECB by hiking last before a pause.

Trade Safe and trade Smart.