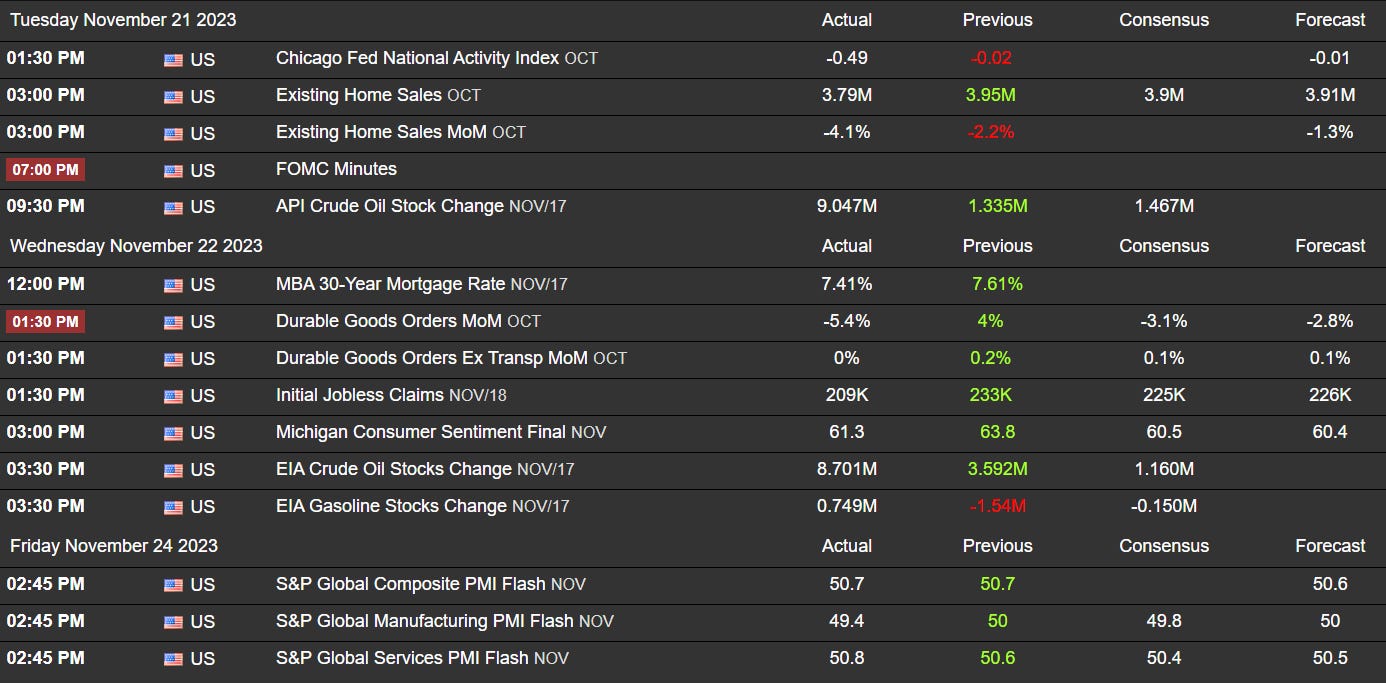

With most of US data released before Thanksgiving with FOMC minutes that did not brought anything new on Tuesday, mixed data Wednesday with poor Durable Goods, but optimistic Jobless Claims and Mich. Consumer Sentiment and today PMI flash also mixed to close of the week marked out to be smaller for US markets due to holidays closures.

The week started with Gold doing a pullback on Monday from 1985s to 1965s, double bottoming and then restarted his trend to the upside reaching 2008s on Tuesday after poor Chicago National Activity. As we have been referring, for Gold to keep above 2000s we need to have stronger catalyst and such poor economic data lead to such upside but failed to sustain. Wednesday, beside we had poor Durable Goods at -5.4%, improvements on Jobless Claims and later on Michigan Consumer Sentiment led to Dollar be more bullish and a bounce on Gold for the 1988s and then consolidated within the 1992s through Thanksgiving with very low V&V and only today was able to retest again 2004s.

On the DXY, we expected that it could retest the 103 flat before bouncing, but bottomed on Tuesday at 103.2 and bounced to 104.2 before turning back bearish again and within the trend.

Since this week is very “smaller” for US markets, our expectations were set lower from our weekly preview. Although Gold gave some good buy entries above the 1965s and sell opportunities from highs at 2007s and 2004s.

With Dollar still printing new lows and now hovering the weekly lows, it will be interesting to see how such daily and weekly closes due to the important economic data we have next week. So far we are still playing the FEDs early rate cuts and with today mixed PMI but the Manufacturing returning to negative territory again which is a sector that we have been having reports of declining, so far the rate majority of the group still sees keep rates until June although the most sees FED to ease still in May.

Looking into JPY, in macro overview, with dollar bearish during November, JPY was only able to bounce during US CPI release after breaking the ATL and even though this week peaked and broke monthly highs, it is now hovering the weekly opening price beside the last night Japan CPI report to be higher than previous and forecast at 3.3%.

Such does not bring risks for currency intervention from Japan MoF as markets are now adjusted, although such CPI increase is inline with BoJ it held minimum to no weight.

Not much to add for such “smaller” week and now the focus will be the preparation for the next one with important US data and EoM.

Be safe, have a great weekend, refresh, reset and prepare for what’s to come.