What week on Gold! Well, unfortunately I wasn’t able to recap daily, but let’s be objective, did anything changed from past week or from our weekly preview? - No. We had long straight bulls on Gold after a minor correction on week open do to “cease fire headlines” over the weekend but no real de-escalation on Israel conflict adding on to dovish FEDs, including Jerome Powell, just led to Gold to keep is bullishness.

As we recapped, the week started very quiet and with de-escalation headlines during weekend made Gold and Dollar to open the week with a gap to the downside. Without much economic data in focus for US, the week brought a lot of FED speakers including Jerome Powell on Thursday. All of them playing the same tape, being neutral to dovish and Powell keeping the speech (check here a speech summary) in the same tone as before in turns of labor, inflation back down to 2%, policy lag effects, etc.. and beside nothing we haven’t heard before, it created a bullish effect on Gold and of course a bearish move on Dollar. The interesting part of such appearance is that for the first time in awhile we started to see chances (extremely low, of course) of rate cuts when, so far, there will be no rate cuts expected at least mid of 2024 but a small percentage of economists are now voting on them.

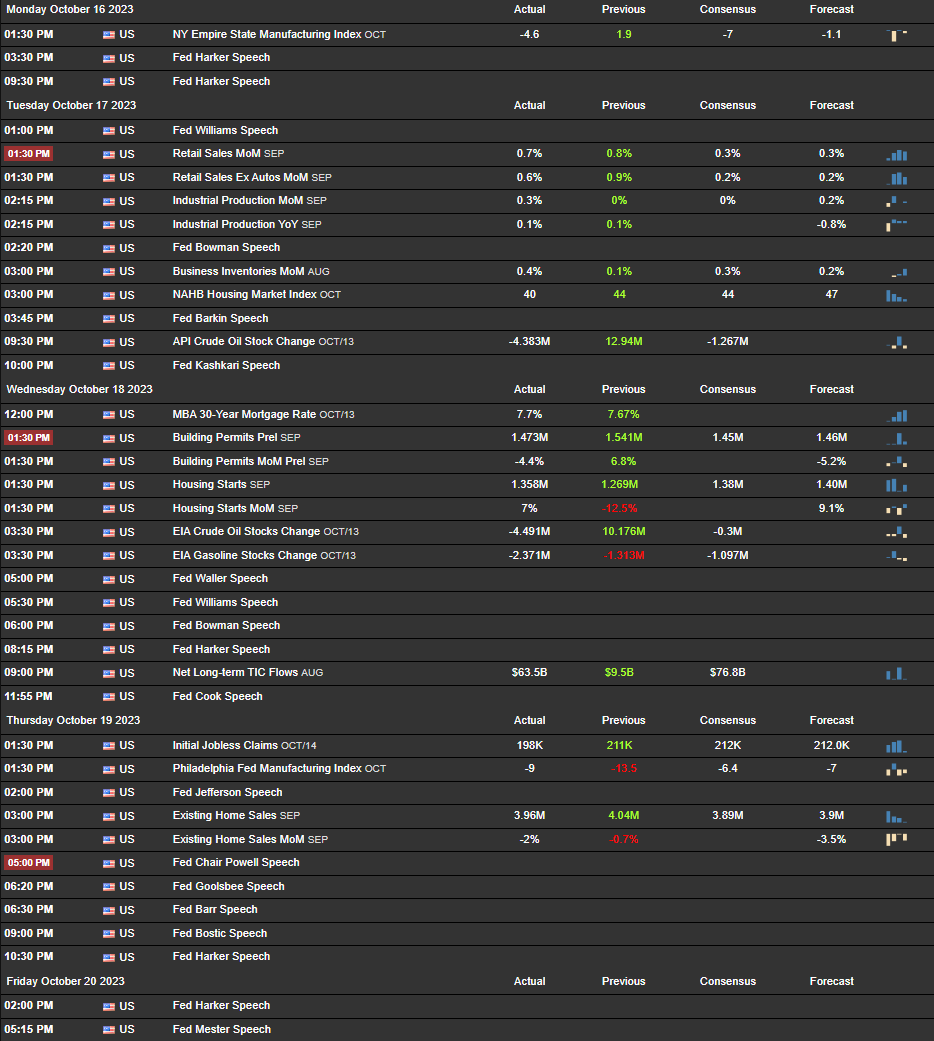

Beside the FEDs, we also had Retail Sales on Wednesday that kept resilient with expectations to decrease more than the actual result but such result did not held much impact on bearish side of Gold due to FEDs and Israel Conflict both pushing Gold to the upside.

In summary, we still have markets on edge with Israel Conflict and dovish FED pushing Gold to the upside, but interesting fact is that we saw Dollar ranging between 106s and 106.6s due to the fact that these two fundamental catalysts are fighting each other in the way that if they are both bullish for Gold leading him to almost hit the 2000USD this week, the conflict is still bullish for Dollar but FEDs dovish are bearish, making dollar pairs a bit choppy for this momentum.

It will be interesting to see the Dollar behavior next week with the blackout period of FED speakers, GDP and Inflation data in focus and the week before FOMC decision, but that we will review in another post.

Have a great weekend, recap the week, refresh and reset.