With a previous week on the edge waiting for any headlines coming from Israel-Hamas conflict that could “shake” the markets, this week won’t much different since such catalyst is still hot and in young stage where markets are still pricing in such event and mainly reacting to headlines.

Further (de)escalations will be noticed as we already stated and even though we are still playing the CB Monetary Policy as the main market driver, such event can lead to a short term sentiment shift, specially on Gold. On the economic reports side perspective we will have a quiet week where Retail Sales on Tuesday and Jerome Powell on Thursday will be more in focus. Beside we have again a lot of FED speakers, they have been playing on the Dovish side and that supports the gold bulls, but they are not bringing nothing new to the table since the no rate hike on November 1st is already priced in.

Not much to add on, beside, the need to keep vigilant on headlines of the conflict that was intensified during the weekend with probabilities to open again with gaps.

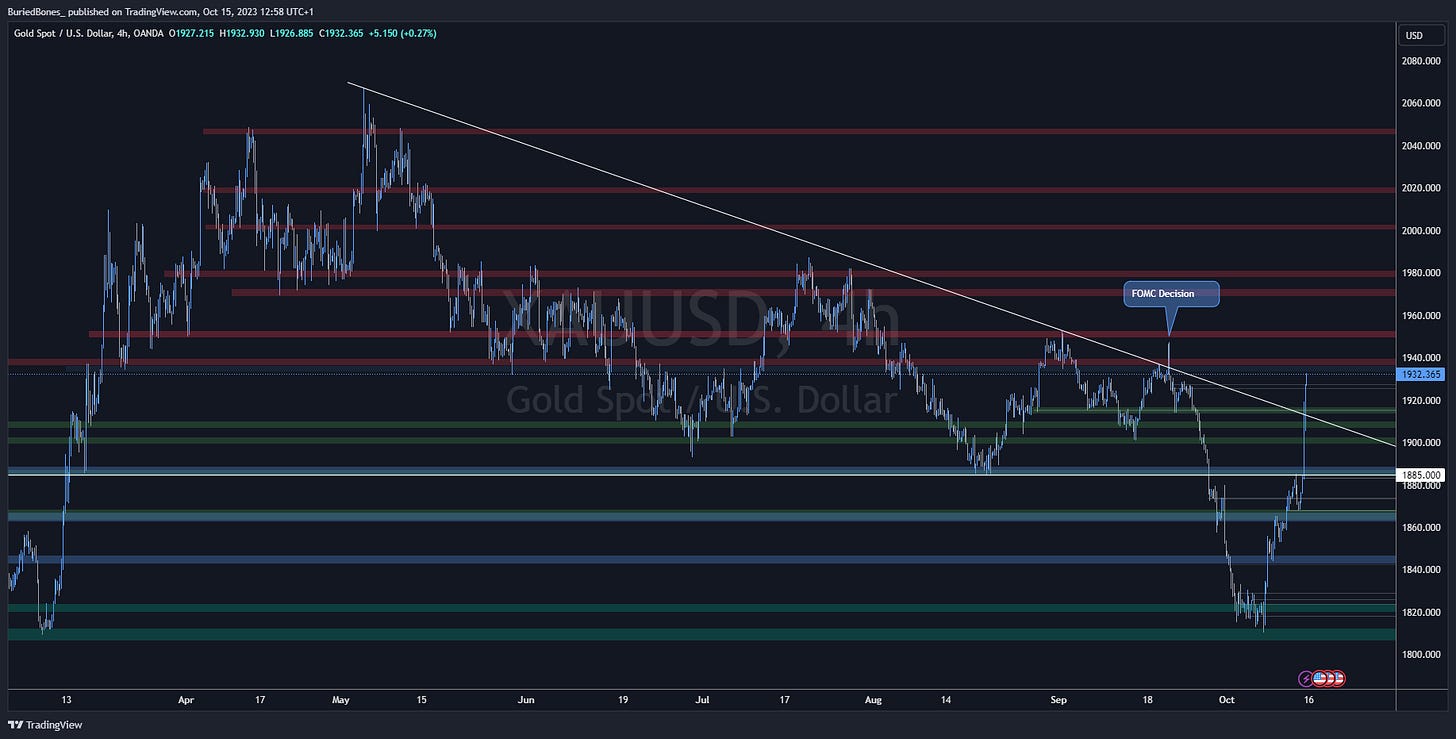

Looking at the PA point of view on Gold, on HTF further escalations could easily fade out the entire FOMC decision move and 1950s will be a very key area to watch out for.

We already broke and closed above that representation trendline, but the important fact is to look at key price points to understand PA potential moves. Hence why we shouldn’t marry a bias, understanding that CB MP is the main market driving factor but the conflict (de)escalation will still hold more weight until completely priced in.

Stay vigilant and stay adaptive.