With this new week already starting, the focus will be on US economic data as we have for GDP, Consumer and Inflation to look out for. With the previous one pretty slow, we have good expectations that this one could give use some good market moves for us to take some advantage on as we keep playing the sentiment of Dollar bulls and Gold bears with resilient US economic data.

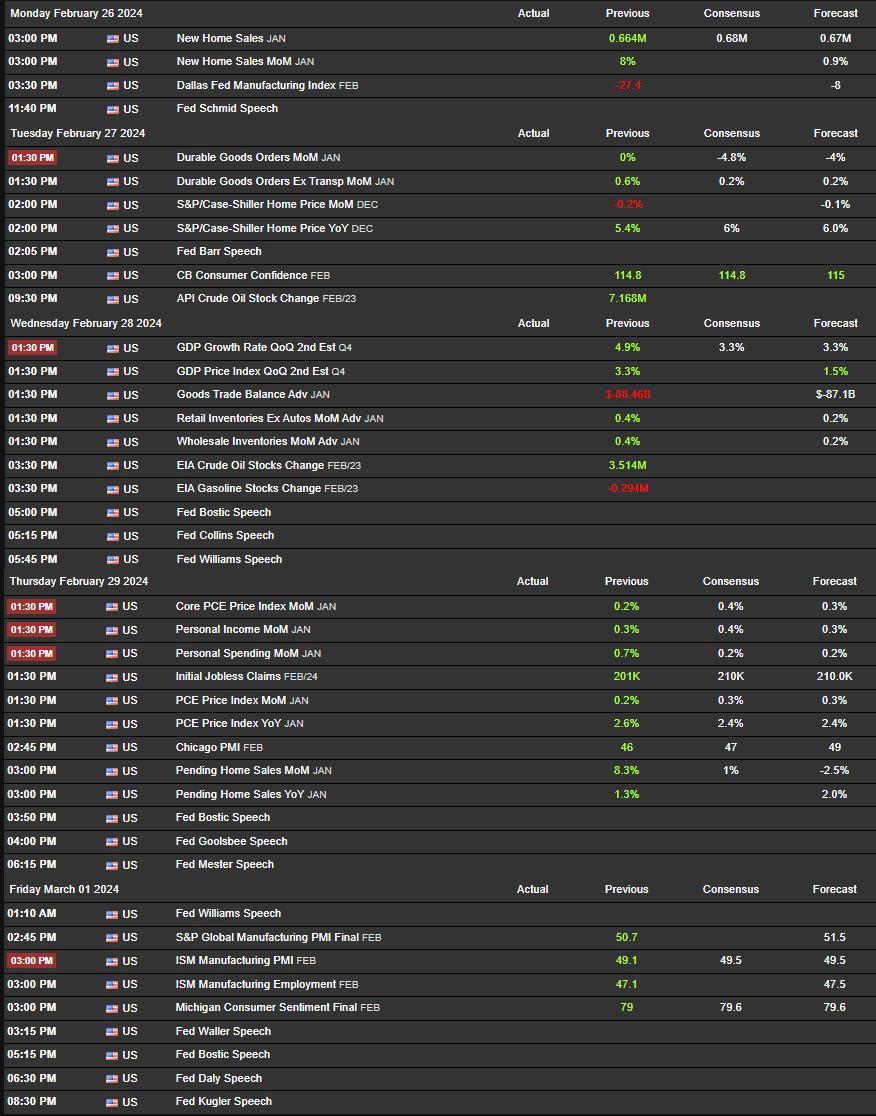

As we can see, we will have different types of US economic data through out the week together with a lot of FED speakers. From the FEDs we don’t expect much as the tone was set by JP from the last FOMC and rate cuts probabilities are still expected for the second half of 2024. Today, as we write such post on Monday 26th, should be pretty quiet, as tomorrow we will have the first report being Durable Goods. Market expectations are to a strong decline, but to be honest we don’t see so sharp. It is true that we have been seeing slowing down on Consumer and Housing data but Labor and Manufacturing are still tight, so yes we see a decline but not as much as markets are expecting. Similar situation on GDP as this will be the second estimate and we still see resilient data to be released.

One of the most expected result and data in focus is PCE on Thursday. This is the inflation figure that FEDs look and if data comes as forecasted, it is still signs that inflation is high feeding the same sentiment of Higher for longer. Remember that PMI, labor and other inflation figures as CPI and PPI are still resilient so if we had a decline here don’t expect much. Friday and the start of a new month, March, we will have PMI and Consumer data and it will be very good if we can see ISM heading into healthy territories (above the 50 grade point) which further feeds the sentiment as Consumer is expected to remain in healthy figures.

Translating such into the charts, bear in mind that we are in the period of transitioning into a new month where Rebalance of Flows could come, but we don’t see it happen to until PCE results.

Beside we are in a bearish bias on Gold due to the market divers, we still chances for Gold to retest 2040s or even 2050s collecting more sell side liquidity before continuing bearish for 1980s or even lower. On the macro HTF we are indeed bullish but the sentiment now is not supporting it and until such shift happens we will keep playing Dollar Bulls and Gold bears with resilient economic data that feeds into Higher for longer narrative rates.

On the Dollar side we have more price areas to look for as after fading out CPI move and retesting the 103.5s, resilient US data will keep him bullish.

We still expect to Dollar to retest 103.8s or 103.5s for better buy side liquidity before pushing to the upside and then price points like 104.2, 104.5s and 105s would be interesting to watch as we expect reaction at such areas.

So for this week we will patiently wait for US economic data and adapt to the results but bear in mind that we need more for such higher for longer sentiment to remain instead of the opposite, so be vigilant and adapt accordingly as if no reactive events show up to change or shift the sentiment momentarily we keep with such bias.

Stay safe and trade smart