A smaller week for US markets due to Monday bank holiday, we anticipated a potential low volume and volatility week due to lack of economic events, and indeed on Gold and Dollar we had pretty slow sessions beside some reactive headlines on Tuesday during pre-London hours coming from China.

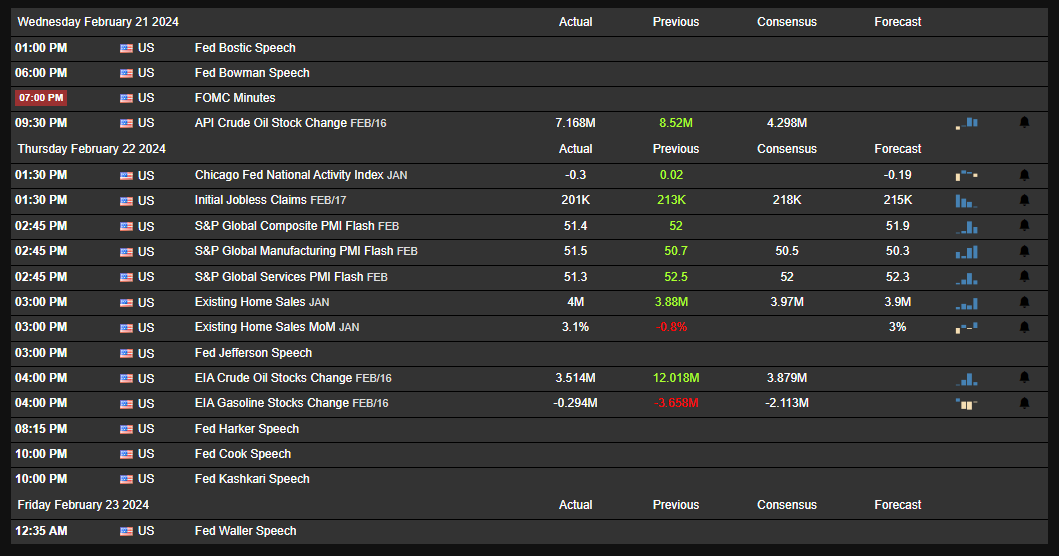

As we can see the short economic calendar we had being Thursday the day with more data. FOMC meeting minutes didn’t brought anything new to table on Wednesday as the hawkish comments from the meeting were already priced in. Thursday optimistic Jobless data went against market expectations and results of mixed PMI flash figures with improvements on the Manufacturing didn’t impact much on Gold and Dollar as we can see below.

As we can see, on week 7 we had the CPI data where dollar printed new high and gold a new low and after that both started a normal pullback move. The first break of 104 on DXY was caused by a reactive headlines that came up on Tuesday, during Pre-London hours (late Asian) where Chinese banks were selling Dollars and buying Yuan. Such market movements is another form of Government stealth currency intervention but in this case were China state banks to do such interventions that causes the same effect.

China's major state-owned banks were seen selling dollars on Tuesday… in an attempt to arrest weakness in the yuan in the wake of a deep cut to the benchmark mortgage rate

Beside Dollar retested previous highs of 103.8, retesting 103.5 temporarily, snapped back up close to 104s where it closed for the week.

On Gold, as we had a slow start, it came into a range area almost for the entire of the week, between 2020 and 2032, breaking high on Friday as we see it as a potential price setup for the coming week which will be much more interesting to watch due to the data that is coming.

Not much to add on and such did not change our view of the markets as we keep playing the Central Bank Policy positioning as market driver and so far we keep with the bias of Gold bears and Dollar bulls as long as we have resilient economic data that feeds into the rates higher for longer narrative.

Stay safe, reset and refresh the new coming week.