What a remarkable week for Gold! Not only hit All Time Highs at 2075.43 (Oanda Feed) but also first time we had a monthly candle close above the 2000s.

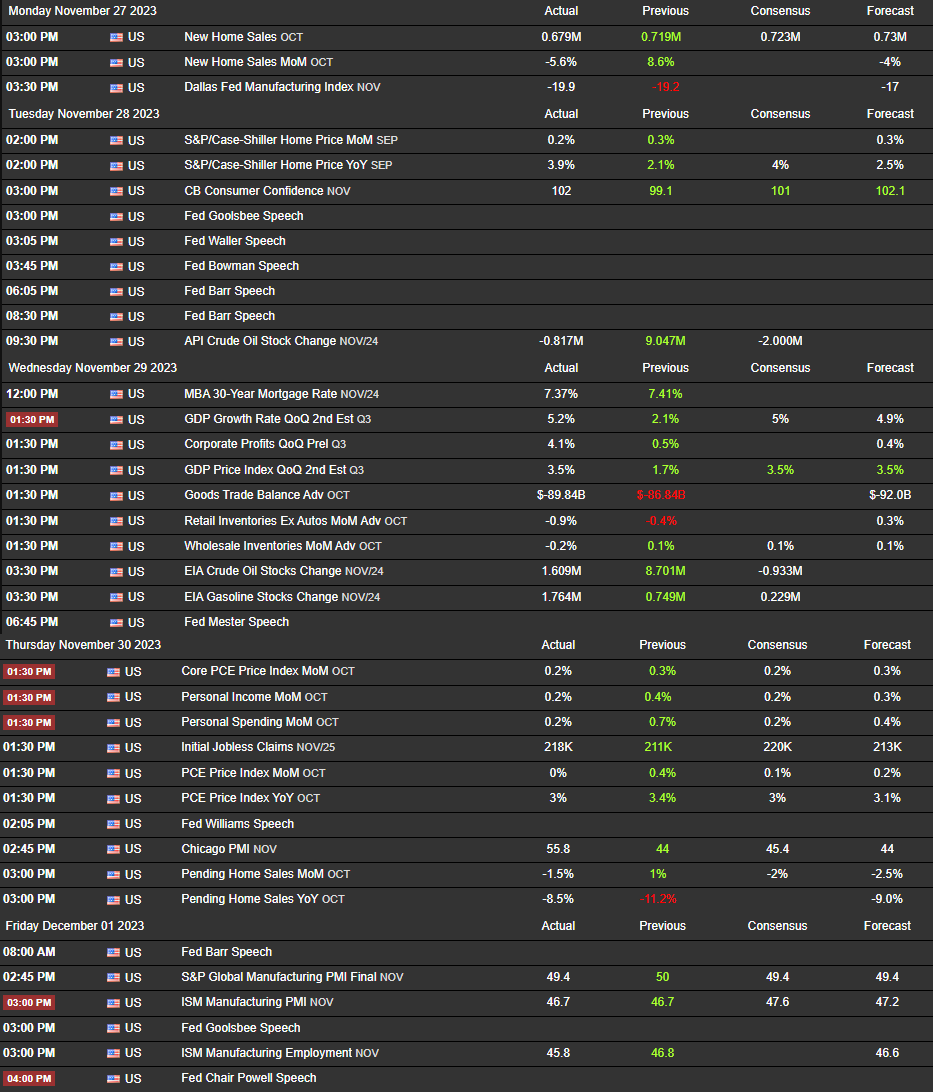

The expectations for the week were good with slow start expected but with potential rise in volume and volatility mid to end week. Although the US economic data reports were neutral to mixed and in one case very optimistic, which seemed very abnormal, Gold kept is bullish stance and in such week no pullbacks whatsoever to hit ATHs.

As we stated on our Tuesday update, Gold pushed to 2018s from 2002s during Asian session and was able to keep above 2010s without any pullbacks for the rest of the week. On Wednesday, where during Asian, dollar printed the weekly low at 102.4s, beside we had another great forecast on GDP, which could lead to Gold to start a pullback due to very optimistic US data at the same time a usually very low impact report on inflation “Core PCE Prices QoQ 2nd Est Q3” came out lower than expected at 2.3% from a previous 3.7% and expected 2.4% and that made Gold and Dollar to range with conflicting data, with eyes set on inflation on Thursday.

Thursday came and during London, Dollar got some good upside move from 1027s to NY at 103.5s due to low inflation reading on different EU countries reported during that morning. Then neutral US inflation report on PCE, where everything came according to expectations and such kept Gold within the range and Dollar at highs of the day. A Side note for Thursday was it was the end of the month, with the monthly candle close and Gold for the first time in history had a monthly close above the 2000s. This clearly show us that such combination and stack of events, Geopolitical tensions and Monetary Policy actions, hold very weight on Gold to keep it and close above the 2000s mark.

Friday came with PMI reports being mixed in the way that S&P came according to expectations and ISM, which usually holds more weight same as previous, came same as previous where forecast was to increase. To bring the final heat into the markets, our boy Powell came and gave some dovish remarks on Monetary Policy and that issued Gold to make a new record at ATHs at 2075.43 and to close off the week at 2071.

“We are getting what we want to get”

Jerome Powell

With such dovish stance, markets reacted accordingly and beside Gold printed such highs, Dollar reversed and closed on 103.1s still within the range of the week. With Powell bringing the “The soft landing narrative” economy and investors are now pricing in even early rate cuts for the 1st Quarter of 2024.

As we can see above not only now we see ease to occur on March but also almost 90% sees another ease to happen on May with rates to be reduced below the 500 points to start out the second half.

In summary, beside the US economic data wasn’t as bad as we were anticipating, Gold kept is bullish stance with repetitive behavior during the week in that way that after such breakout moves consolidated accumulating more orders (orange boxes) before continuing up with a very strong bullish rally.

Nothing more to add for such week, now the focus will be to prepare the new upcoming week marked out with US employment data.