Interesting week ahead with major Central Banks decisions and the focus will be on Bank of Japan on Tuesday Asian Session and beside all the expectations of what FED will do, our focus for Wednesday will also be on Summary of Economic Projections.

As we can see above, FOMC meeting will be in focus for the week in terms of economic data. Housing market on Tuesday is not expected to bring much volume and on Thursday Flash S&P PMI, NY Manufacturing and Jobless claims will be the last day of expected economic data. With FOMC meeting, the FED blackout period will be finish and we start to have some Fed Speakers right after.

Starting with FOMC meeting, my personal expectations is that such meeting could be very similar to the previous one with FED to keep rates as-is and Powell to be pretty much neutral on his speech and not bring anything new to the table. For the meeting, beside of course Powell speech, will be the Economic Projections for the remain 2024. This will be released at the same time of the decision and the focus here will be mainly the dot plot in the way that we will see how the members position themselves in terms of rate cuts for 2024.

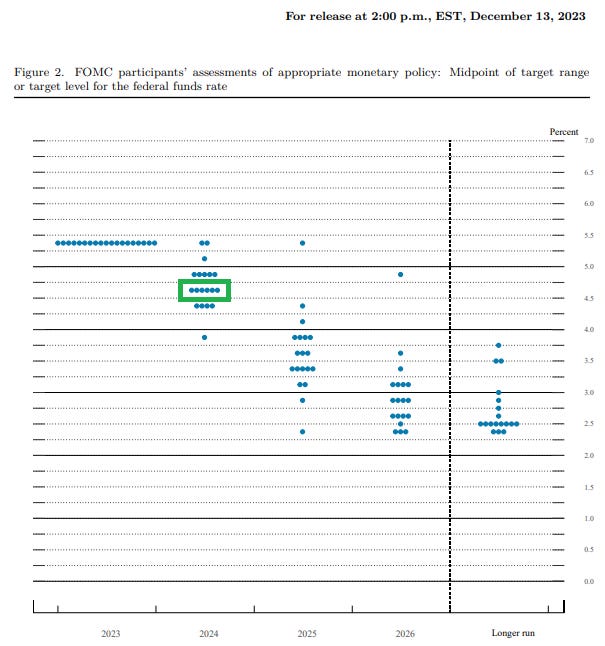

On the last SEP of December 2023, majority of the members positioned themselves for rate cuts to 4.5-4.75 for 2024 as we can see below.

At the moment, beside markets tried to anticipate rate cuts in March early this year, the CME probabilities match the above dot plot.

In summary, it will be interesting to see if the FED members have the same positioning as before in the way that changes will make markets to react and adjust accordingly. Not only we will get to know what members see at this moment in time but we also get to know the projections of the FED for PCE, GDP and Unemployment rate. Last SEP expectations for UER on 2024 were at 4.1% (now at 3.9%), PCE to be at 2.4% and now the Core is at 2.8% and PCE at 2.4%.

In terms of markets expectations, we will keep the same bias as dovish Powell will keep feeding the rate cuts with Gold bulls and Dollar bears and I still see both doing healthy pullbacks for better price setups before continuing such trend.

I will keep the same areas of interest for price reaction and only switch bias if fundamentals will tell us so.

Looking now for BoJ, the main focus will be of course the decision that since last year they have been throwing some curve balls on the chances of leaving the negative rate and last Thursday with a typical news before the event that were “make arrangements” to end negative rates. No matter what during the decision that will occur next Asian session, Yen could turn very volatile and if a hike will come with Ueda to be more hawkish it will lead to turn Yen bullish, else it will keep bearish. I still think that they won’t make any hikes now and just is still only fireworks with chances of last headlines being just false flags beside agreements on wage hikes for major companies. According to Reuters poll, majority of the economists still see most probable to have hikes in April.

Reuters poll: BOJ to end negative rates in April, high chance of March, analysts say

Source Reuters

No matter what we need to be very vigilant and objective as a retail traders with BoJ decision if something changes we can see high spreads, brokers freezing, orders slippage due to the volatility and it is better to wait for the dust to settle and then jump in more safely as changes on Japan policy haven’t occurred in the last 17 years so bear in mind that history can be made soon.

Stay safe, trade smart and don’t forget that markets are always here and offers tremendous opportunities.