With a previews week where we saw one sided movement on Gold and Dollar due to poor US economic data, we arrive to know the CPI results before the FOMC meeting next week. Beside US CPI we will also have PPI and Retail sales mid-week and to close of we will know the preliminary results of Consumer Confidence for March.

As we can see above, today (Monday) will be pretty quiet in terms of expected economic data as the focus will be on CPI on Tuesday.

Expectations on Core CPI is to have a slight reduction and but CPI MoM to increase 0.1% as YoY to remain the same. Our view is to CPI to keep within the expectations, without any surprises, if not slight decreasing due to the fact that energy prices remain quite stable and we have been receiving poor economic reports on Manufacturing, labor side, wages reduction and consumer side, in contrast with still good expectations on GDP and Personal Income that increased from Jan to Feb. Although it is important to understand that this report will be pretty significant for the next meeting of FOMC, not because they will change the IR (which I don’t believe) but to assess what JP will have to say. If any surprise like CPI increase would come, much probably we could see markets pricing out rate cuts on June and delay it for the month after or even after summer (as August there is no FOMC meeting). So be vigilant on such day and if all data comes as expected the the actual bias is to keep. On Thursday we will have Retail sales that even if it comes as expected (which I personally don’t see it to be so high) is still within normal ranges, similar to Durable Goods and Factory Orders so might not hold market weight if PPI does not meet expectation. I see chances for potential decreasing for the same reasons explained above on CPI as we have seen poor economic data across the board so if a slight decrease will come I won’t be much surprised. Then to close of the week the preliminary Mich. Consumer Sentiment for March but first we will have NY Manufacturing index which will be interesting to see the result as well as Industrial Production that is expected to rise a bit.

Translating such into the markets, as we stated on our weekly review, we are starting to have fundamental reasons to switch our bias in terms of market sentiment in the way that, if the week before we saw Gold moving up with no easy correlations, last week we had fundamentals that support it is upside as well the downside on Dollar, breaking the bullish market structure that we were considering. So far our bias is to keep Gold bullish and Dollar bears.

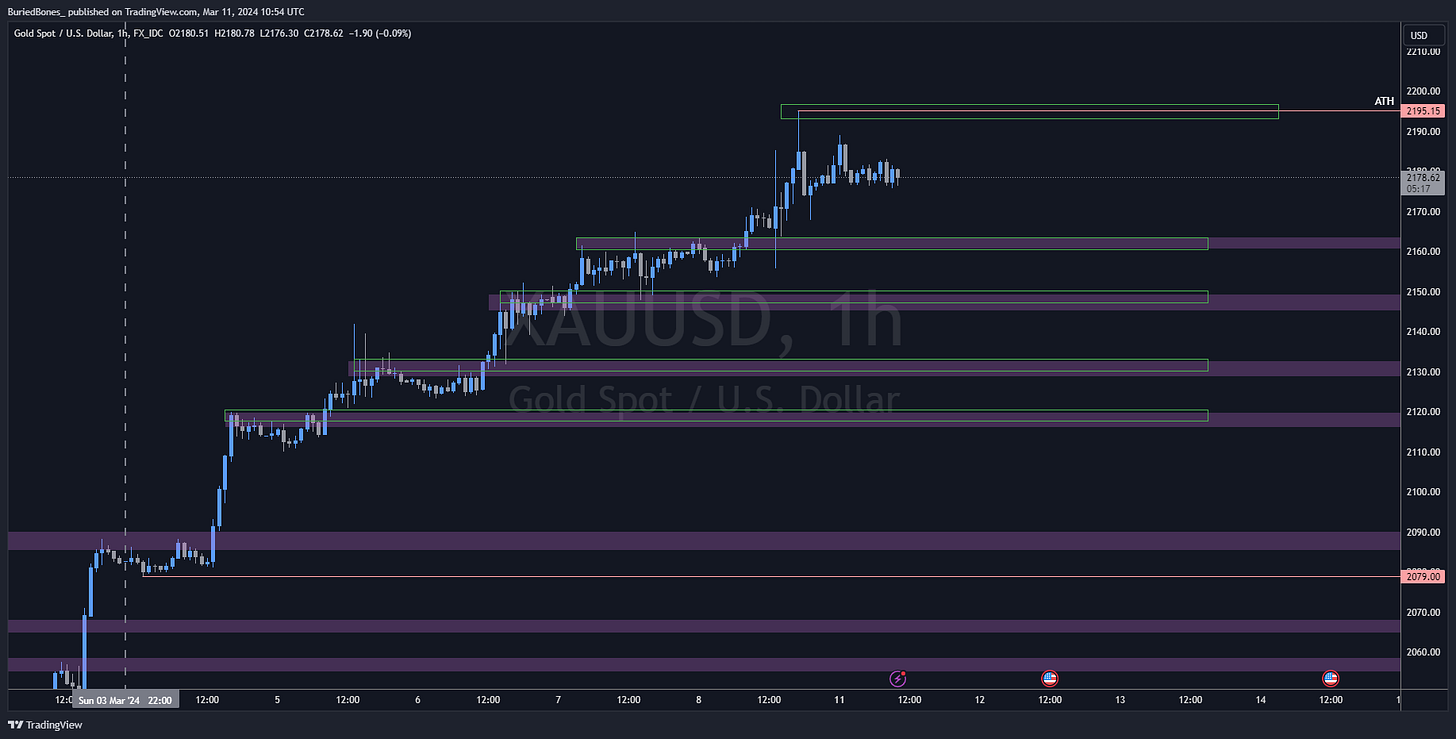

On the perspective of Gold if wee see pullbacks, which would be very beneficial for better buy opportunities on the green areas, areas like 2160s, 2150s, 2131s is where I look for potential buy entries or continuations above ATH. It is also possible for price to come 2120s and if it won’t hold we might see Gold to deep as 2088s to retest previous highs. Data will be key to support such bias and setups and CPI will be the main factor to dictate if we will see the Higher for longer or to keep potential rate cuts in June. On my view if data comes as expected or slight decrease we will keep our bias, if higher we could see a correction taking place with buyers taking profits in ATHs.

The same will apply on Dollar but in a inversed way of course. We will keep playing Dollar bears with fundamental supports knowing that CPI will also be the main kicker

No matter what, what is important to understand is that this CPI reading can set the tone for the rest of the week and until FOMC, in the way that high readings could lead to rates higher for longer and lower readings to keep the bias. If it comes within expectations, we need to carefully assess due to the fact that we can have a fight between narratives of Higher for longer VS Rate cuts as one side see it sticky inflation and FEDs job is not done (beside UER at 3.9%) and on the other side is greed to keep pushing it so be adaptive and stay vigilant.

Trade safe and back test previous CPI results in order to prepare for what is to come.