New week and last month for the first quarter of 2024, we will have in focus Jerome Powell testimony before House of Financial services Committee and Senate and labor data with NFP and UER to close of the week.

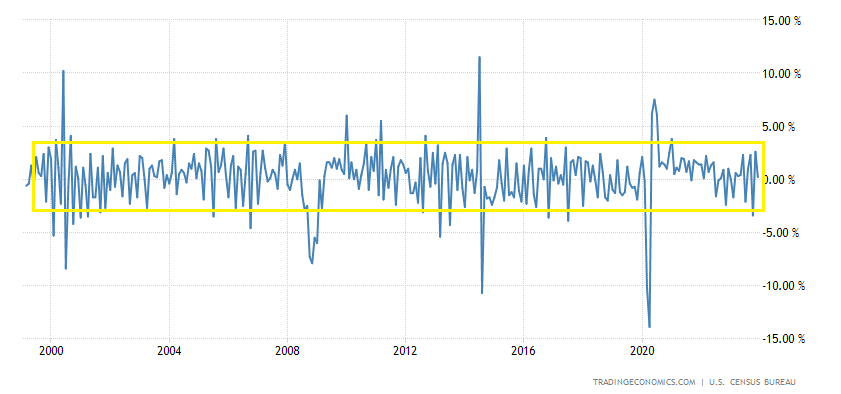

As we can see, Monday will be pretty quiet on economic events and on Tuesday we will start with PMI data. Remember that last week on Friday we had poor ISM Manufacturing PMI which was against our expectations, so it will be interesting to see Services PMI result as we have seen the manufacturing side with low readings, as well as softening on the consumer side beside still tight labor data, so it is indeed possible that we can see some decrease on such indicator. At the same time as ISM, we will have also factory Orders that is expected to decrease to -2.8%. If such would occur, the same market impact is expected like we had on Durable Goods as such value is still within the range of normal fluctuations as we can see below:

We can only expect market impact if some surprise on such report will come but understand that the highest impact is ISM PMI on this day.

On Wednesday all eyes will be on Jerome Powell testimony. This will be the first appearance of the week. If you back tested previous occurrences, the first one is usually the one holding more weight as the speech is very similar and so well priced in. Here we need to react to Powell speech as markets will be keep adapting and bear in mind that hawkish JP will bring Gold bears and Dollar bulls, but if you usually don’t like to trade the news, wait for the dust to settle as markets digest information and then if so could try late entry for continuation moves. Before JP we will have the first report of labor with ADP and then at the same time of the speech the JOLTS. On both we can see some market impact with a strong surprise, but it is JP that will be in focus for this day. Similar to Thursday for his second appearance and with Jobless claims if it comes within forecast not holding much market weight as the focus for labor is on Friday.

Friday 8th with NFP and UER. For such report I indeed see some decline on NFP, due to high readings of previous report, but not as much as the expectation and also I see minimal to no changes on UER. It is true that we are seeing signs of Manufacturing softening, but labor market is still tight and within FEDs expectations. An important report we should also look, will be on Wages as it is an inflation trend indicator. We saw last week an increase on Personal Income so it will be interesting to see what would such readings be.

In terms of markets, it will be interesting to watch such market open and Asian session to see Gold behavior due to its move during NY that I personally don’t still have a fundamental reason for it. Nevertheless it closed at 2082 and my expectations is for Gold to correct the move at least but I see many AOI to play on Gold.

As you can see above, the 2040 and 2090 will be for me make or break areas in the way that continuation buys above 2090 and sells below the 2040s. Although I see potential corrections of the move before Powell appearance, or even NFP if JP would be neutral, and of course depending on ISM on Tuesday, so that yellow boxes will be areas that I will look for reactions for continuation sells or if fundamentally supported a buy areas. On my personal view I see no fundamental reason for Gold to be traded at these levels but we just need to adapt and take what market provide as in the end of the day I have no personal attachment to Gold price unless understand to where it can go and follow it. Our bias in terms of market sentiment is still playing the Central Bank policy positioning, in the way that Gold bears and Dollar bulls with good US data, so JP speech can be determinant to see what Gold can do before labor data on Friday.

On the DXY perspective we keep with the same analysis as last week in the way that Dollar just ranged and we still have the same Areas of Interest to play with.

In this way, I would recommend to back test previous NFP and JP appearances in order to prepare for next week and keep an eye on markets open to see what Gold can do, beside we have no major headlines during the weekend that can gap Gold price.

Stay safe, trade smart and be adaptive.